tennessee auto sales tax calculator williamson county

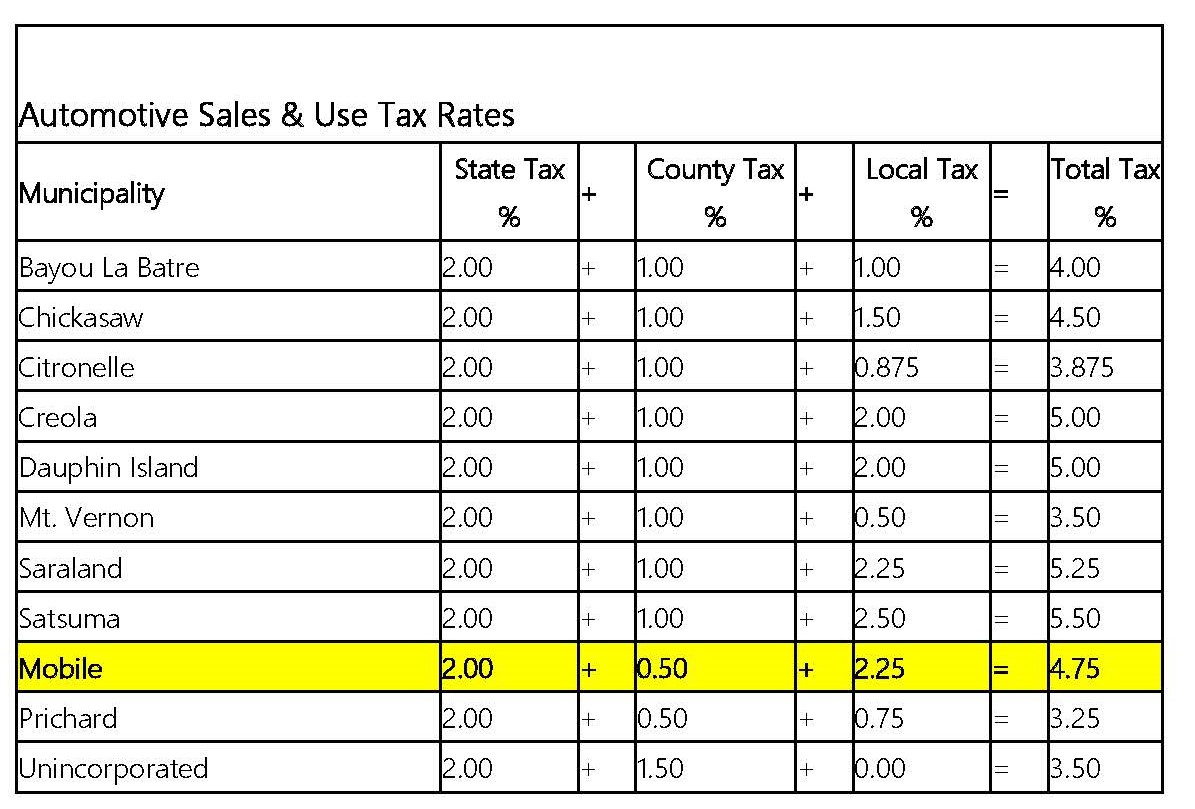

The Tennessee state sales tax rate is currently. Total vehicle sales price 25300 25300 x 7 state general rate 1771 Total tax due on the vehicle 1851 if purchased in Tennessee Minus credit for 1518 FL sales tax paid.

Williamson County Voting Sales Tax Referendum Brings Out Voters

This is the total of state and county sales tax rates.

. You can calculate the sales tax in Tennessee by multiplying the final purchase price by 07. Net price Purchase Price minus trade-in. Williamson County in Tennessee has a tax rate of 925 for 2022 this includes the Tennessee Sales Tax Rate of 7 and Local Sales Tax Rates in Williamson County totaling 225.

TAX RELIEF TAX FREEZE. The Williamson County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Williamson County local sales taxesThe local sales tax consists of a 225. The current total local sales tax rate in Williamson County TN is 9750.

Estimate My Williamson County Property Tax. The vendor fees associated with credit card. For example lets say that you want to purchase a new car for 60000 you.

WarranteeService Contract Purchase Price. Vehicle Sales Tax Calculator. Vehicle Sales Tax Calculator.

Williamson County Tennessee has a maximum sales tax rate of 975 and an approximate population of 154784. When using the online property tax payment option there is a 150 fee for all e-checks and a 215 fee for all credit card transactions. The use tax is the counterpart to the sales tax.

Choose Avalara sales tax rate tables by state or look up individual rates by address. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. Download our Tennessee sales tax database.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Blountville TN 37617. All individuals as well as businesses operating in the state must pay use tax when the sales tax was not collected by the seller on otherwise.

If sales tax value is greater than 1600 but less than 3200 your Single Article Tax is 275 after 1600 If sales tax value is more than 3200 your Single Article Tax is 4400 Disclaimer. Sales tax will be collected on the purchase price of the vehicle less trade-in if any net price. Just enter the five-digit zip.

Please call our tax relief specialists at 615 790-5709 if you have questions about the programs or would like to schedule an appointment. The December 2020 total local sales tax rate was also 9750. Our Williamson County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property.

Dekalb County James L Jimmy Poss 732 S Congress Blvd Rm 102. Sales tax rates in. The minimum combined 2022 sales tax rate for Williamson County Tennessee is.

Tennessee has a 7 statewide sales tax rate but.

How Much Do You Really Pay For A Gallon Of Gas Williamson Source

Car Loan Calculator Tennessee Dealer Consumer Calculator

Where The Jobs Are Williamson County Tn 20 Money Magazine

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Car Sales Tax Everything You Need To Know

Property Tax Rates Williamson County Tn Official Site

Tennessee Property Tax Calculator Smartasset

Cottages For Sale In Williamson County Tn Zerodown

Tennessee Vehicle Sales Tax Fees Calculator Find The Best Car Price

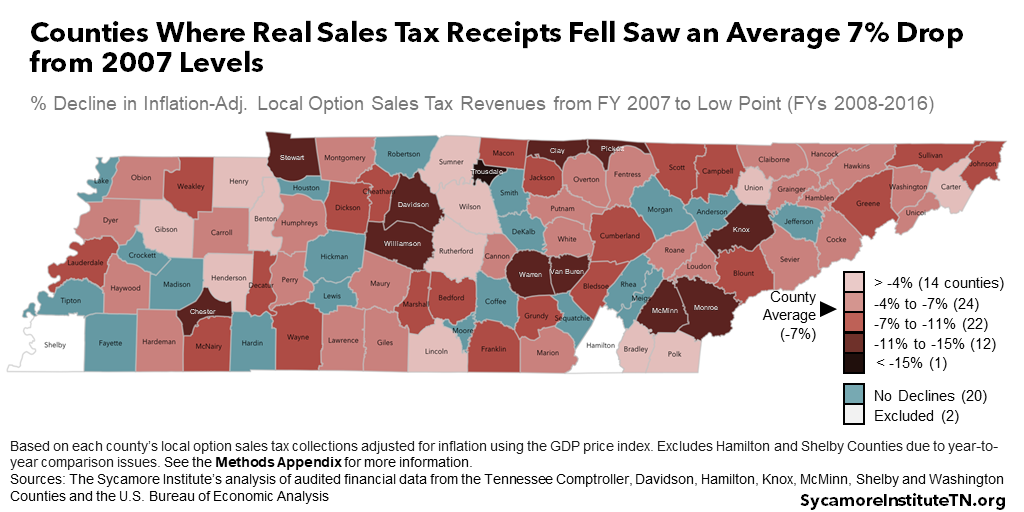

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Williamson County Approves 650m Budget 1 88 Property Tax Rate

Tennessee Income Tax Calculator Smartasset

Williamson County Tennessee Tn Sheriff Police Patch Ebay

Tennessee Property Tax Calculator Smartasset

Carol Birdsong Williamson County Tennessee No School Tomorrow T Shirt Large New Ebay